➡ Click here: Wechat pay malaysia

Now you have successfully linked your bank card with WeChat! Alipay introduced a separate app for the Hong Kong market in May, its first non-yuan app. This means e-payment used in places such as wet markets and even newspaper stands.

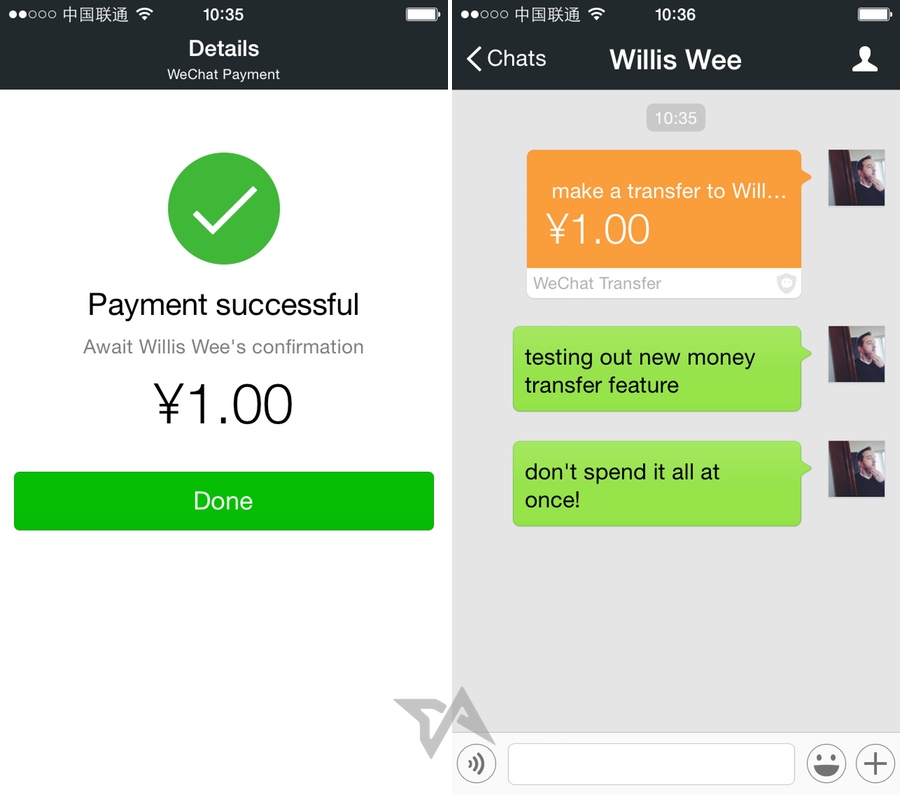

I solo using my PBB CC but in order wechat pay malaysia withdraw the RMB1 have to register Debit Card. Easy to use from your mobile too. Everything you need to know about Insurance Let the Experts teach you about Insurance Tools and FAQ guide for tax e-filing Income Tax 101 with our con to use calculator and tax guides. Great deals on household items Great discounts on household decorations, furniture and appliances. QR-based transactions can done two ways: by the user scanning the merchant's unique QR code, or the merchant scanning the user's unique QR code. Local banks are already on WeChat Pay. Between is a pop-up message stating there is no charges involved for withdrawal up to RMB1K. Users can also withdraw funds from this wallet, and have it back in their bank accounts in two working days. I register using my PBB CC but in order to withdraw the RMB1 have to u Debit Card. Malaysia will be the first country outside of China to receive WeChat Pay. Maybe there's a bug since I google that most of it has the option to do it.

Having these popular payment option available for your users will increase the conversion on your Apps. Where To Use WeChat Pay In Malaysia? Currently, the red packet and transfer are not available in Malaysia yet. With Tencent claiming that 60% of the 20 million users in Malaysia are Malay, this could be a fun party trick for Raya that may evolve into a legitimate daily usage feature for some users.

Join our mailing list! - You will have two options to create a WeChat Cross-border Payment account.

Compare the best credit cards Find the credit card that meets your needs and apply online. Choose a card for the way you live Credit cards with deals and discounts that make the most of your lifestyle. No more debt - instant 0% interest Move your debt to a low interest balance transfer credit card. A safer way to shop online Compare and apply for the best debit card for your daily transactions. Unlimited cash rebates every day Get the best cashback credit cards in Malaysia for instant savings. Airmiles and overseas travel deals Choose the best travel credit cards in Malaysia and get free access to KLIA lounge. Be sure you're getting the best deal Simplify the process of getting your housing loan approved - get advice from our experts. New or used we've got your covered Find the best car loan for buying a new or second-hand, foreign or local vehicle. Buy with easy monthly instalments You can afford it when you convert your shopping to simple monthly instalments. Fund your next business venture Working capital for SMEs and startups Get cash within 24 hours Personal loans with instant approval and fast cash disbursement. Simply internet on the go Shop mobile broadband plans for your computer, phone, or tablet. Grab your mobile and line with one simple plan Compare all smartphone postpaid and prepaid plans, we've got all iPhone, Android, Blackberry and Windows phones Stream quality TV on any device Bundle your internet plan with TV entertainment for the family. Restaurant deals and discounts Enjoy exclusive restaurant discounts and privileges in Malaysia. Deals on gadget and media Get the latest deals on the coolest gadgets in the market. Offers on clothing and acessories Find attractive discounts on clothing, shoes, handbags and accessories. Great deals on household items Great discounts on household decorations, furniture and appliances. Save your favourite promotions Bookmark all your favourite promotions instantly for you to access anytime. Learn personal finance Learn about banking basics or go in depth on specific finance topics. Tutorials to help you save money Learn how to manage your money with our collection of online tutorials. Everything you need to know about Insurance Let the Experts teach you about Insurance Tools and FAQ guide for tax e-filing Income Tax 101 with our easy to use calculator and tax guides. The launch is taking place in stages, as the feature is rapidly being made available to the country's 20 million users. This would potentially allow for a widespread and seamless adoption of the service, allowing Malaysians to use WeChat Pay in Ringgit Malaysia. How To Enable WeChat Pay After a lengthy two-year beta testing period involving 10000 Malaysian WeChat users, WeChat Pay is now ready for the masses. To enable Quick Pay, WeChat users simply need to top up their app's mobile wallets. This is done by adding any Visa or Mastercard debit cards issued by Malaysian banks, and transferring your desired amount to the wallet. Once this is done, you will get a QR code that can be scanned to initiate the payment process. For security purposes, the QR code is refreshed every minute. Users can also withdraw funds from this wallet, and have it back in their bank accounts in two working days. WeChat Pay in Malaysia also supports a few other features at launch, which are powered by third-party operators. You can top up prepaid credit, or even buy bus tickets directly from within the platform. The list of features will definitely increase over time, as WeChat gets more local partners onboard. It is likely that Tencent will be looking to push another popular feature before Hari Raya Aidilfitri next week. In China this year, in just five days during the Chinese New Year celebration. With Tencent claiming that 60% of the 20 million users in Malaysia are Malay, this could be a fun party trick for Raya that may evolve into a legitimate daily usage feature for some users. Where To Use WeChat Pay In Malaysia? Tencent is likely to address where users can use WeChat Pay in Malaysia when it officially announces it, with rumours of a 11 June official launch date being mentioned. But this is likely to be just formalities, because the company has as the merchant acquirer for WeChat Pay services in Malaysia late last year. This means Hong Leong Bank will be the touch point for local merchants and businesses who wish to support WeChat Pay as a payment option. Initially, this was to support the influx of Chinese tourists who use WeChat Pay, but it appears this move was also to provide end-to-end support for Malaysian users as well. In addition, Tencent is also expected to announce some merchant partners that will accept WeChat Pay at launch. Given the huge amount of WeChat users in Malaysia, there is also an incentive for retailers of all sizes to embrace WeChat Pay. After all, the process is exceptionally quick and seamless, and can easily be conducted on their smartphones. With Bank Negara pushing for a standardised QR-based mobile payments platform, it is only a matter of time before we can use e-wallets like WeChat Pay virtually anywhere. Bank Negara has already issued dozens of e-wallet licenses since last year to a wide range of companies, from Grab to Digi, in addition to the traditional banks. Is WeChat Pay Safe To Use? WeChat Pay works just like any other QR-based mobile payment service. In fact, this is a much safer option than using cash. QR-based transactions can done two ways: by the user scanning the merchant's unique QR code, or the merchant scanning the user's unique QR code. After scanning, the merchant or user keys in the amount to pay, and the transaction is complete. WeChat Pay's Quick Pay feature can also be set to have a payment PIN request upon each transaction. This means that upon scanning the QR code and keying in the transaction amount, the user is required to enter a six-digit payment PIN before the transaction is made. This can be disabled if the user prefers it. In addition, the user's QR code is time-limited: the app generates a new unique QR code every minute, so nobody can snap a photo of your unique QR code and try to pay using it. On top of that, each QR code is only valid for one transaction. Finally, the maximum daily amount of payment made via Quick Pay is RM4999. Also, WeChat Pay Malaysia cannot be used on jailbroken or rooted smartphones. There's even a FAQ inside the WeChat Pay service, which can be found in the triple dot menu button on the top right of the app. It is no surprise that Tencent selected Malaysia as the first country outside of China to expand WeChat Pay's services. In , Tencent Senior Vice President S Y Lau, revealed that Malaysia was a great starting point for expansion, before adding that the company already has an e-payment license issued by Bank Negara Malaysia — a regulatory permit that will allow it to roll out WeChat Pay in Malaysia. Time To Go Cashless In the coming weeks, we'll likely hear more about WeChat Pay in Malaysia, both from Tencent as well as its retail partners. Could this be the catalyst for the start of Malaysia embracing the idea of a cashless society? You also have your word! Currently, the red packet and transfer are not available in Malaysia yet. That said, you can use still WeChat Pay in Malaysia by switching your wallet region. Hopefully, the two features will be made available soon. Thanks for the answer and we hope this help. However, it should be noted that WeChat pay is being rolled out in stages. So, if your current WeChat wallet does not have the feature now, it will have it in the near future. You could always contact Hong Leong Bank for more information. Thanks for the question and we hope this help. That said, we need to wait for further updates from WeChat on this part. Thanks for the information and we hope this helps. If you need more help, you can head to WeChat Help Center Thanks for the question and we hope this helps. I have switched region to Malaysia and found out the balance is 0. Thanks for the question and we hope this helps. However, it is in your best interest to also contact WeChat on this matter. Thanks for the question and we hope this helps. Post Top Insurance Comparisons Top Credit Card Comparisons Get the best credit card sign-up offers from Malaysia's most popular bank when you apply with RinggitPlus. OCBC provides great credit cards for cashback and unlimited privileges. RinggitPlus' exclusive OCBC credit card sign up offer is the best around. Our comparison of the top credit cards for holidays and heavy travellers, frequent flyers, Air Asia VIPs, get free air miles faster. Read about all available islamic card-i banking cards that are Shariah compliant and free of Riba and Gharar. Browse the top petrol credit cards for drivers and commercial travellers, fill your tank for less at Petronas, Shell, BHP, and other petrol stations Leading premium credit cards for the VIP, instant access to airport lounge privileges, golf benefits, luxury resorts and major hotels. Our top list of shopping credit cards gets you more discounts and rebates on your everyday purchases at leading supermarkets,hypermarkets, and malls. Shop more for less at AEON, Tesco, Giant, Parkson, and more. Talk to us Open Monday to Friday 10:00AM to 7:00PM Not a big talker? Easy to use from your mobile too. All your banking questions about credit cards, debit cards, personal loans, home loans, car loans, savings, and investment are answered in our comprehensive articles. Get the most out of Malaysia's banks and finance companies when you save, invest, insure, buy and borrow. Reviews for the top credit cards in Malaysia. Understand the pros and cons for each card and discover the features and benefits that could save you thousands of ringgit every year. Get explanations on banking terms and jargon straight from the mouth of the leading financial comparison website in Malaysia. We've made our glossary to help you understand the fine print like a banker. Have you come across a term used in your insurance policy that you've misunderstood or don't understand? To help you make sense of the jargon that's often used to describe insurance, here is our handy guide to the most commonly used key words and phrases. Get the better deal.